George Soros is known for his sharp eye in global finance, and the 1990 Gulf War proved just how powerful that insight can be.

While most investors saw chaos, Soros saw opportunity—and quietly placed one of his most profitable trades. As markets panicked, oil surged, and currencies swung wildly, he made hundreds of millions by betting on what others overlooked.

For African investors, this moment holds powerful lessons. Because no matter where you’re based, the ability to read global shifts, stay calm in uncertainty, and act with precision is what separates winning investors from the rest.

Background: George Soros, The Gulf War, and Global Markets

To see why George Soros stood out during the 1990 Gulf War, you first need to know who he is and why his approach to investing sets him apart.

The Gulf War was a turning point for investors everywhere, forcing the world to watch both the battlefield and the trading floor.

These two stories are tightly linked, and understanding their connection gives real insight into how Soros seized his moment during one of history’s biggest market shakeups.

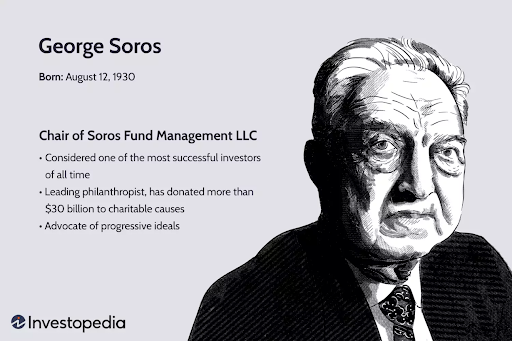

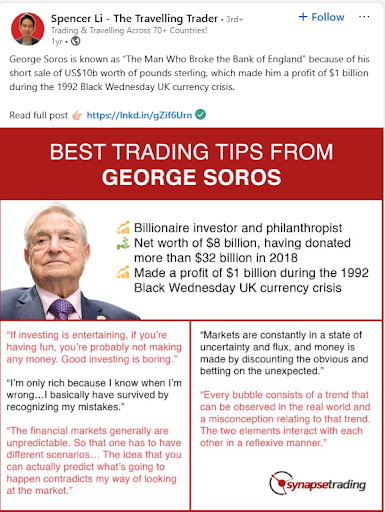

Who is George Soros?

George Soros is often called one of the smartest investors alive. He’s best known for turning macro insights into major profits. He looks at how investor psychology and global events create feedback loops—where perception drives price as much as reality does.

Key elements of his strategy:

- Spot global imbalances before the market reacts

- Take calculated risks when the odds tilt in his favor

- Stay disciplined, never betting based on panic or emotion

- Think independently—even when it means standing alone

He’s most famous for “breaking the Bank of England” in 1992. But long before that, the Gulf War trade cemented his reputation.

How the 1990 Gulf War Shook the World Economy

The Gulf War started when Iraq invaded Kuwait in August 1990. The world watched in shock as Saddam Hussein sent troops south, taking control of Kuwait’s oil supplies almost overnight. This single event shook energy markets and global trade.

The implications were immediate and far-reaching:

- Nearly 20% of global oil exports were suddenly at risk

- Oil prices surged, hitting levels not seen in years

- Currencies of oil-importing nations weakened under the pressure of rising import costs

- Stock markets grew volatile, with investors unsure of what would happen next

- Political risk skyrocketed, particularly in the Middle East and among Western allies

Every headline sparked a new wave of reactions in the market. Airlines saw their stock plunge. Oil companies soared. Import-dependent economies struggled.

But while most investors reacted emotionally to the chaos, Soros zoomed out and followed the ripple effects—watching how one geopolitical shock was causing a chain reaction across currencies, inflation rates, commodities, and investor behavior.

It was this deeper understanding of interconnected systems that gave Soros the edge.as markets moved with each headline.

How Soros Capitalized on Market Turmoil During the Gulf War

Identifying Opportunities in Global Crisis

Soros and his team scanned global markets for signs that fear had moved prices too far.

He focused on:

- Currencies vulnerable to oil shocks, especially those of oil-importing nations

- Commodities and stocks mispriced due to panic

- The interconnected impact of oil, inflation, and political tension across markets

He wasn’t guessing—he was analyzing. While others followed headlines, he followed the data.

Soros’ Short-Selling Strategies and Execution

Soros is famous for making bold bets when the odds favor him. During the Gulf War, short-selling was one of his key tools. That means he borrowed assets—like a weak currency or slipping stock—sold them, and planned to buy them back later for less, pocketing the difference.

Here’s what made his strategy stand out during the chaos:

- Currency speculation: Soros spotted that the British Pound, tied to an uncertain European economy and reliant on expensive oil, looked weak. He took large short positions, betting its value would fall as the crisis deepened.

- Leveraged bets: He didn’t just use his own money. By using leverage, Soros controlled much larger positions than his actual cash on hand. This amplified gains when he was right.

- Commodities moves: Oil was the big headline, but Soros also watched how rising oil prices would ripple into other sectors, including commodity-linked currencies and energy stocks.

His trades combined deep research, fast decision-making, and a willingness to act when others paused.

The Results: Profits and Market Reactions

Soros’ actions delivered huge results. Estimates put his profits from these trades during and right after the Gulf War in the hundreds of millions of dollars.

- Timeline: Most of these gains piled up between August 1990, right after Iraq moved into Kuwait, and early 1991 as the war unfolded and markets tried to find new normal.

- Market reaction: Other investors noticed someone was making big bets, but few knew who stood behind them until much later. His success forced traders and big investment firms to respect his speed and discipline.

- Ripple effect: Some banks and funds copied his moves, while others scrambled to catch up or limit losses after missing the early signals.

Soros’ performance during the Gulf War added to his reputation as one of the sharpest minds in finance. For investors watching from Africa or anywhere else, his story shows how careful study, courage, and quick action can turn turmoil into opportunity.

Key Lessons African Investors Can Learn from Soros’ Gulf War Strategy

The brilliance of Soros’ strategy is that it’s not tied to Wall Street. It’s a mindset any serious investor—anywhere—can adopt.

Global Events Have Local Effects

Soros didn’t trade oil. He traded what oil touched—currencies, economies, stocks. African investors can do the same.

For example:

- Rising global food prices? That affects local inflation and FMCG companies.

- A rate cut in the US? That might push money into emerging markets.

- A war in the Middle East? That could raise transport costs and pressure African importers.

The key is to ask: What does this global event mean for me?

Don’t Follow the Crowd—Study It

Fear moves faster than facts. Soros knew that panic often leads to opportunity.

In African markets:

- A sudden currency devaluation? Look for export-focused companies that benefit.

- A dip in oil prices? Time to reassess transport, agriculture, and even real estate.

Train yourself to look past noise and find the opportunity hiding behind it.

Protect Your Capital First

Soros bet big, but always with a risk plan.

You can manage risk too:

- Diversify—across sectors, currencies, and asset classes

- Use stop-losses or clear exit strategies

- Keep liquidity so you can act fast when opportunity comes

- Don’t let one loss take you out of the game

Prepare, Then Move Fast

Soros didn’t win because he predicted the future. He won because he was ready when it arrived.

So:

- Do your research. Study your market.

- Follow key indicators—commodity prices, currency rates, global news

- Build your watchlist now. So when the market moves, you don’t scramble—you strike.

Ready to Turn Global Events into Opportunities?

George Soros showed us that with the right mindset, even global crises can become stepping stones to wealth.

For African investors, this isn’t just a story about Wall Street. It’s a wake-up call. Whether it’s a conflict, a commodity shock, or a political shift, global events always have local consequences. If you know how to read them, you can build a stronger, smarter investment strategy—right from home.

That’s exactly what The Global Hustlr helps you do. We break down global investing for Africans—giving you clear insights, practical tools, and timely analysis you won’t find in the headlines.

Subscribe to The Global Hustlr

And start turning uncertainty into opportunity—one smart move at a time.